The best programs for online accounting

- Radoslaw Salak

- 15 gru 2018

- 8 minut(y) czytania

Zaktualizowano: 12 wrz 2022

The best programs for online accounting

The tax settlements for 2016-2017 for the companies in the UK is getting closer and for the people who have some additional incomes.

Therefore I decided to describe for countrymen in the UK that there are systems that help in maintenance of books and records in the XXI age.

No matter if you have a small-sized firm or you have not too big additional incomes or if you run a serious business.

The accountancy in the UK can be banally simple for anyone and accounting systems online are the best choice.

The comparison of software to accountancy management for small-sized firms in the UK

On the market there are many various systems starting from free and ending on chargeable under the subscription and the special offers are being created by bigger sized offices of accountancy in the UK.

While making a choice of the utilities you should take into consideration some specifications.

A pleasant system for your eye

Easy to use

Function of reports generating

The price

The popularity of programing

Stability (so that firm will not disappear)

Support for bookkeepers

Trainings

A mobile version

A mobile application for conversions

ect

The tax settlement in the UK is simple. The person with average knowledge in English language will handle with self-assessment.

The first position is waveapps

https://www.waveapps.com/ is a software for accountancy management with the global mark. It is commonly used in the USA and Canada but also for users in the UK there are some interesting solutions.

Amongst others there is possibility of conducting a standard accountancy with invoicing services, booking on account and fiscals (possibility of functioning), connection with bank accounts or PayPal.

The big plus is the possibility of issuing an invoice with implemented requirement of payment through the account on stripe.

If you employ people or you have LTD I have a bad news. The Payroll is available only for users from the USA and Canada.

The possibility of invoices issuing, the accounting in different exchanges when in cases of other systems the following function is known as something very cool and you will have to turn on more expensive subscriptions.

There is also the reports system. If you have a company in the UK you need to know the place where you spend your money the most often, information about the client who generates the highest earnings ect. Thanks to the reports you have possibility to monitoring your all paying outs and incomes.

One of the most advanced functions is so-called automatic billing what give a possibility of repeated issuing of invoices. It is a very essential function for distributors who sell subscriptions.

As you can see the system offers a lot and it is for free. Therefore I mentioned it as a first cause a lot of Polish people in the UK run small-sized companies in the UK or only earn some extra cash and wave is a perfect solution for them.

However the settlement of VAT in the UK under the software for accountancy should be much easier.

However the software does not have an integration with HMRC hence it is impossible to send the annual tax declaration directly to the HMRC system. You need to make it on the government site.

The chargeable versions of other systems for accounting (not all) make it possible to do. You should remember that Waveapps is not compatible with the HMRC systems

]

If the taxes in the UK are something hard to understand, that system should be helpful for you. The QuickBooks is one of the most popular systems for accounting in the UK.

The software is dedicated to the British market so you have a possibility of launching the payroll and the settlements VAT according to requirements of HMRC. It is also possible to make a year settlement under the integration with HMRC.

The software is always chargeable. There is also some promotions for the new accounts. The subscription often starts from 6 pounds for the basic account to 25 pounds which is dedicated for firms LTD.

The Polish people cannot manage account in different exchanges in the basic option. Almost every distributor in the UK collaborate with the Polish firms so that means you need to buy the above package.

However the prices are not high in comparison to the competition.

I really encourage you to compare the packages and making the right decision if you are going to choose some. Finally if you want to run a company in England you need also care about reasonable outcomes.

That is a great solution for LTD contributions because there is a possibility of VAT settlement and payroll function.

https://www.zoho.com/en-uk/ is the next software for accounting management online for firm in the UK which by functionality remind its predecessor. The company praises that it has many integrations with systems such PayPal, Stripe, slack, dropbox etc.

What are the prices?

The basic version starts from 6 pounds per month and ends at 18 pounds (the most expensive variant) After comparison of different subscriptions I consider that the basic variant is sufficient for the majority companies.

Here it is worth to mention that many companies reduces their software’s for accounting functionality and the reason is that they want to bring more clients showing the lower price.

The additional feature for system is the possibility of monitoring the time intended for projects. There are systems for time management and here you have it implemented in the accountancy program.

It may be a nice asset for freelancers.

The other advantage is magazine. The system of that type is very often implemented in such accountancy programs. The big plus is that they have internet shops.

The ZOHO under the brand ONE have different systems for distributors and the accountancy online is just one of a few separate applications. Under the group ZOHO you can buy a software CRM, mailing and many others. For more information I invite you to visit the site of the producer.

The software for accounting freeagent.com is well-known in the UK. They praise themselves that they’re number one. If you have a corporate account in the NatWet bank you will get access to the system for free so it is some kind of solution for seekers of savings.

What I like in that company is a nice interface. It is designed on a high level so it’s easy and pleasantly to work with this software. It means that the taxes in the UK may be settled with pleasure.

Naturally as befits for a professional system you have the most important functions like VAT or integration with banks so called time tracking.

The one missing function is the possibility of sending the year taxation to HMRC from the level of accountancy program.

What makes me sad is the prices for freeagent.com The simplest subscription starts from 19 pounds and the most expensive for LTD contributions are valued for 29 pounds. I won’t provide the promotion prices cause these are practical in every firm and purchase of subscription for such systems is associating firm for a longer time.

The big asset is that the company is directed to the British client and it is manager by British people. Therefore you have the choice of account for Sole Trader or for Limited Company and the projection of system is especially for all English firms.

Thanks to it the accountancy program is very popular in that country.

The company is noted in London with the price of 75 pounds and the results of netto profit are in each year negative not including the growing income. Maybe that is because of the subscription price.

The other meaningful aspect of that software is a huge amount of external systems integrations.

The sage.com is a global giant with established position on the market. In practice every software of that kind is like that and here are many functions starting from integrations with banks ending on payroll.

The choice of account starts from 6 pounds for micro-sized firms but there are no settlement of foreign exchanges so for the majority Polish in the UK this version is not profitable and the higher package costs 20 pounds. The prices are free of VAT.

Honestly after analyzing the basic account functions there is no possibility of sending a pro forma what means that the basic version only want to bring the clients and show the low prices.

After analyzing functionality I think that many people will be required to buy the higher package.

The payroll function you need to pay separately. The advantage is integration with HMRC. The company praise by so called RTI what means that by only one click you can send to HMRC need information about PAYE.

Here the charges are dependent on the workers number and in the case of 1-5 persons the chargé is 6 pounds + VAT.

.

The kashflow.com is the next accountancy program online dedicated to British market. It distinguishes by numerous integrations and over 57000 satisfied clients. It means that many distributors use that software.

The prices starts from 7 pounds per the basic variant but you can benefit from functionality of accountancy software online. You need to buy a significant number of additions and integrations with the other systems.

The company is one of a few which has integration with HMTC and you can settle a tax in the UK directly from the level of software.

Currently there is holiday promotion available and if you will pay for 1 month you will get 3 extras. The promotion code is: 3monthsfree

The xero.com is the last one system for accounting online in my comparison. That is the system also with all characteristics, all needed tools for distributors in Great Britain who want to manage the accountancy online.

The biggest asset is the magazine. The half of accountants don’t have it in their offer, eventually it gives a possibility of integration with the external systems.

Here we can also issue invoices with possibility of paying online by PayPal or by credit card. Not all firms offer such possibility. Here a big thumb up for possibility of choice.

On the website you will find more described additions so I encourage you to check it out. However after knowing with functions I can steady conclude that Xero is a serious multi-tasker.

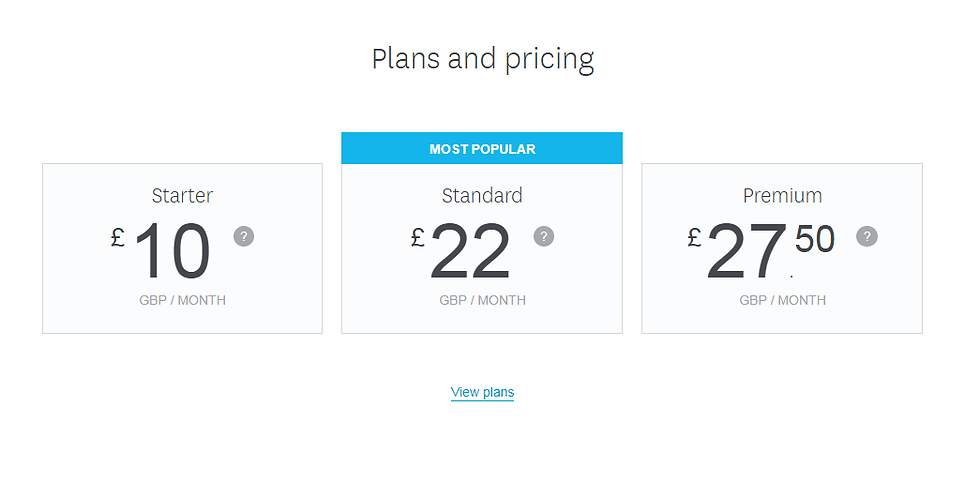

The prices for subscription starts from 10 pounds per one month by 22 for 27.50. As in case of other firms, the basic version has no sense if you run a firm in the UK

Summary

Personally I think that it is worth to use the software online for accounting so settlement of tax in the UK is much easier. Naturally you can do it in excel or on any device. However we live in XXI age so we need to go with the times and use special services.

Finally they make our live easier because of importing transactions from the bank account or PayPal you can issue an invoice with possibility of paying it. You can just set automatic shipment to the subscription fee.

The best systems can connect with the bank account and check if the FV was paid. If yes the system will credit an amount if no it will send a warning.

The other ones will help in filling the year statement and prepare beautiful reports which will show where you lose the profits and what generates you funds in your firm in the UK.

After checking above mentioned systems I noticed that the basic packages are redundant and they have big limitations so be ready to purchasing it in a higher package in case of contributions LTD here you need to pay out for directors hence you need to buy the payroll programe.

For my blog I use the free application weaveapp, but I start to looking for something else what will replace my current system.

If my blog will be constantly developing now I think that within 2 years I will have to premise a contribution LTD because additionally it will have no sense to exercise one person activity.

I hope that if you run the company in England you use some accounting system online. Please write in comment if you use such systems. If yes, please provide its name.

Perhaps there are even better systems not mentioned here that I don’t about.

When it comes to prices in the most cases of accounting systems online, they are shaping at the same level between 10 and 30 pounds.

However if you firm in the UK benefits from the Excel tables I encourage you to make changes in accounting system and the taxes in the UK will be easier to settle.